Right. Here's your preliminary report. The next step is…

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

WHY CHOOSE EXPRESS ESTATE AGENCY?

Rated the number 1 estate agent in the UK (Review Centre)

Rated the number 1 estate agent in the UK (Review Centre) Selling around 350+ properties per month

Selling around 350+ properties per month We aim to sell properties within 30 days

We aim to sell properties within 30 days Specialist Sales Progression department

Specialist Sales Progression department Help you negotiate a lower onward purchase price

Help you negotiate a lower onward purchase price

Enormous advertising on hundreds of websites

Enormous advertising on hundreds of websites Established company with 120+ employees

Established company with 120+ employees No sale, no estate agency fee

No sale, no estate agency fee 24/7 buyer enquiry line

24/7 buyer enquiry line Only deal with potential Buyers in a position to proceed (unless commercially

appropriate)

Only deal with potential Buyers in a position to proceed (unless commercially

appropriate)

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

What makes Express Estate Agency different?

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

How Express Estate Agency Compares

High street estate agent

Often considered as being behind the times with regard to technology and many have made next-to-zero investment in innovative technology solutions

Express Estate Agency

Cutting-edge technology supporting skilled professionals in delivering great success and customer satisfaction

Budget online estate agents

Many believe technology will oversee the entire process of selling a property by almost completely removing industry professionals and allowing vendors to sell their property in a DIY manner

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

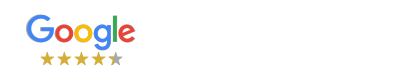

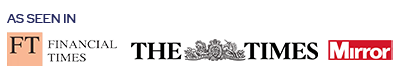

Market Leading Technology

- Track your property sale from the first enquiry to Completion of Contracts

- Receive real-time Live Updates (including viewing requests, feedback from viewings, offers and much more)

- Access your personalised Move Checklist to help make your move as seamless and stress-free as possible

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Sold Properties

Sold Properties Available Properties

Available Properties

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

"We predict that the national asking price of a home – which is currently £342,401 – will rise by 5% this year, which will mean an increase of about £17,000. This is because we're still seeing a huge number of home-hunters looking to move, and not enough homes available to buy, so the imbalance continues to push prices up."

"As always, there will be variations to this across Britain. Currently the most competitive locations for buyers are in Scotland, the West Midlands, the South West and Yorkshire and the Humber. Our forecast shows these areas are likely to see price growth of 7% or more."

"Prices haven't risen as much as they have in the rest of the country, and buyer demand is not as strong, so we forecast slightly lower price growth of 3% in the capital."

Russell Galley, Managing Director of Halifax: 1% rise"With the prospect that interest rates may rise further in 2022 to subdue rising inflation, and with government support measures phased out, greater pressure on household budgets suggests house price growth will slow considerably."

"Nevertheless, interest rates will remain low by historic standards and property prices will continue to be supported by the limited supply of available properties."

Richard Donnell, Research and Insight Director at Zoopla: 3% rise"2021 is set to be a record year for the housing market with the most moves by homeowners since 2007 and nearly £500bn of home sales."

"The impact of the pandemic on the housing market has further to run but at a less frenetic pace."

"We expect the momentum in the market to outweigh some emerging headwinds from higher living costs and the risk of higher mortgage rates."

Lucian Cook, Head of Residential Research at Savills: 3.5% rise"2021 has been a remarkable year for the housing market, underpinned by a strong economic recovery, widespread reassessment of housing needs, ultra-low interest rate environment and, for the most part of the year, a stamp duty incentive."

"It will be difficult to replicate these market conditions throughout 2022."

"We have pencilled in annual price growth of 3.5% across the country as a whole for 2022, but this is on the basis that the so-called ‘race for space' will ease."

Andrew Wishart, Property Economist at Capital Economics: 5% rise"At the end of 2020 we were roughly in line with the consensus in expecting house prices to dip in 2021. But policy was then changed to be far more generous than we anticipated, which caused the usual relationships between house prices and the economy to break down entirely."

"The big risk has to be a faster and larger rise in interest rates than we are forecasting. A rise in interest rates to 1 per cent should be bearable and would likely only cause house price growth to grind to a halt, rather than see prices fall. But if a larger rise in interest rates to about 2 per cent were needed, that would push up mortgage servicing costs to a point where in the past we have seen house price falls follow."

Call me later

Want a valuation & offer? We will call you back in 28 seconds.

Want a valuation & offer? Choose a convenient time and we will call you back.

| 2022 | 2023 | 2024 | 2025 | |

| Savills | +4.0% | +6.5% | +4.5% | +2.5% |

| Hamptons | +3.5% | |||

| Rightmove | +3.0% | +4.5% | +4.3% | |

| JLL | +2.5% | +4.0% | +5.0% | +9.6% |

| OBR | +7.8% | +6.1% | +4.2% | +5.3% |

| Average | +5.0% |

Call me later