EXPRESS INDEX - HOUSING MARKET UPDATE - February 2026

There are many UK housing market indexes released every month and we are attempting to provide the ultimate, comprehensive overview to the very fragmented reports available.

UK HOUSING MARKET SNAPSHOT

Average House Price

(Price Paid)

£270,000

Monthly Change -0.7%

Annual Change 2.4%

5 Year Change 17.98%

Source: HM Land Registry

Average House Price

(Asking Price)

£368,019

Monthly Change 0.0%

Annual Change 0.0%

5 Year Change 15.51%

Source: Rightmove

Number of Sales Completed

62,799

Monthly Change 6.4%

Annual Change -29.7%

5 Year Change -39.63%

Source: HM Land Registry

Sales Agreed

Monthly Change 0.8%

Source: Rightmove

Total Available Properties

677,885

Available Properties Change

Monthly Change 0%

Average Time on Market

189 days

Source: Home

Average Time to Sell

81 days

Source: Rightmove

Price Reductions

0.5% properties price reduced last month

Source: Home

Mortgage Approvals

Annual Change -8.4%

Source: Bank of England

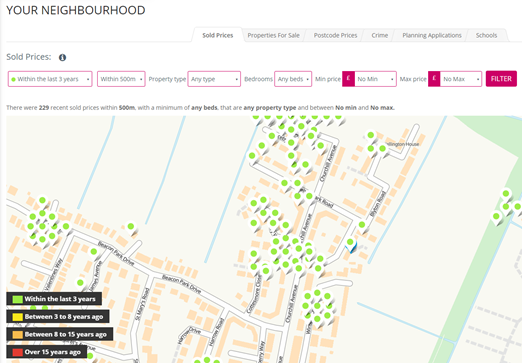

POSTCODE DISTRICT DATA

- For the ‘Price Paid Data’ we use the most recent HM Land Registry data for home sales in England and Wales between September 2023 - March 2024.

- We use a rolling 6 month snapshot of home sales in each localised Postcode District to reduce potential volatility.

- In order to reduce the effect of outliers. We calculate average Postcode District prices using the median rather than the mean. This creates a more realistic representation of local transactions.

- Traffic light system key: Green = Yoy > 2% br> Amber = Yoy >= -2% and Yoy <= 2% Red = Yoy < -2%

REGIONAL HOUSE PRICES

NATIONAL HOUSING MARKET COMMENTARY

"The average asking price of newly listed homes for sale is virtually flat this month, falling by just £12 (-0.0%) to £368,019. This February’s price standstill, compared with a typical 0.8% February rise over the past decade, follows a record January price jump last month. Emphasising how large January’s price increase was, the first two months of 2026 combined are still the strongest start to a year for prices since 2020, up by 2.8% since December. Price growth at the start of this year has been front-loaded more than usual due to an early-year boost in buyer and seller confidence as Budget uncertainty ended. This is supported by Rightmove’s monthly confidence tracker, which measures the sentiments of home-owners, renters, prospective first-time buyers and landlords towards the market. It shows that net confidence among buyers and sellers in January returned to its highest level since September 2025. In February, January’s price gains have held, but new sellers have refrained from further increases to prices as market realities set in. Competition among sellers remains at an eleven-year high, and buying activity is lower than at this time in 2025, after last year’s early rush to complete purchases before stamp duty charges rose in England."

"The January 2026 RICS Residential Market Survey suggests market conditions may be starting to turn a corner, with several activity-related indicators recording their least negative readings for several months. Furthermore, while near-term expectations remain relatively cautious, there is growing conviction among respondents that a recovery in sales volumes will gather momentum over the year ahead."

REGIONAL HOUSING MARKET COMMENTARY

"When disaggregated, a widening divergence is becoming evident across different parts of the UK. In particular, Northern Ireland and Scotland continue to see house prices move higher, while respondents in the North West and the North of England report prices on an upward trajectory. By contrast, the latest net balances remain more negative than the headline average in London, the South West, the South East and East Anglia, albeit in each case to a lesser degree than last month."

"Regionally, more than half of homes for sale are cheaper to buy than rent in the North East and Scotland, followed by the North West. In contrast, higher house prices in London and the Midlands mean that fewer than 40% of homes are cheaper to buy than rent.

HOUSE PRICE PREDICTIONS FOR 2025

Tim Bannister, Property Expert at Rightmove: 4% rise

“More people choosing to make their move in 2025, teamed with lower mortgage rates, could push house prices up by 4% over the course of 2025… The big picture of market activity remains positive… which sets us up for what we predict will be a stronger 2025 in both prices and number of homes sold.”

Amanda Bryden, Head of Halifax Mortgages: 0% to +3% rise

“We expect modest house price growth in 2025, likely a little lower than this year at up to +3%… While further cuts to Bank Rate are still on the cards, the pace looks likely to be more gradual than previously anticipated… buyer demand should continue to hold up well.”

Richard Donnell, Executive Director at Zoopla: 2.5% rise

“The housing market has been resilient… Higher income growth and lower mortgage rates have helped reset housing affordability… We expect this to continue over 2025.”

Lucian Cook, Head of Residential Research at Savills: 1% rise

“Interest rates have fallen as expected, giving buyers a bit more financial capacity than they had a year ago… Greater geopolitical uncertainty… has made predicting the precise path of further cuts more challenging.”

Nick Barnes, Head of Research at Chestertons: 3.4% rise

“Chestertons forecasts that property prices will rise by 3.4% across the UK and 3% in London in 2025, supported by lower mortgage costs, modest but consistent growth for the UK economy and inflation staying around the Bank of England’s 2% target.”

HOUSE PRICE PREDICTIONS

IMPORTANT LIABILITY STATEMENT

An ExprEstimate is simply an estimation of what your property could be worth in current market conditions. This is calculated using an automated computerised system. We use a number of publicly available data sources to help calculate our estimations, maps, tables and other content. This data may be inaccurate or incomplete at times and therefore must not be relied upon. Our valuation estimations, maps and tables are provided to you for personal use, general interest and to provide homeowners with a useful starting point when trying to assess their property’s current value and the UK property market in general. These estimates, maps, tables and any other content should not be relied upon for any type of commercial transaction. We strongly recommend that you seek a professional valuation from a qualified surveyor / qualified professional before any property sale, purchase, mortgage or related purposes. We shall not be liable for any losses you or anyone else suffers as a result of relying on the valuations, maps, tables and any other content. This includes not being liable for any loss of profit, loss of bargain, loss of capital through over-payment or under-sale or for any indirect, special or consequential loss. We cannot and do not guarantee that the Service will be constantly available or error-free. Also, our liability to you is limited to £100. WE DO NOT EXCLUDE OR LIMIT OUR LIABILITY FOR ANYTHING WE ARE NOT ALLOWED TO AND YOUR STATUTORY RIGHTS AS A CONSUMER ARE NOT AFFECTED BY ANY OF THESE TERMS AND CONDITIONS.